This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

News

Housing in the Crosswinds: 3 Trends to Watch in 2020

The National Association of Home Builders (NAHB) unveiled its 2020 housing forecast data at the Leading Suppliers Council meeting that took place at the International Builders Show (IBS) in January. Billed as “Crosswinds for Housing,” the data reveal mixed messages: some hopeful signs for the sector but also continued cause for concern.

Big picture, the economy is slowing—but the risk of a recession is low. GDP growth is forecast at 1.8 percent for 2020 and 1.6 percent for 2021. Interest rates are forecast to increase gradually over the next two years, with 30-year fixed rates rising to about 4 percent.

The housing forecast, meanwhile, is equally murky. Lumber prices are finally dropping, having declined 14 percent since January 2018. As a result, the price of building materials rose only slightly (1.3 percent), the slowest year-to-date growth in four years. At the same time, however, lots supplies are tight. In fact, 58 percent of builders reported “low” or “very low” lot supplies after years of gains.

Here are three key trends to watch.

1. Millennials could be poised to enter the housing market.

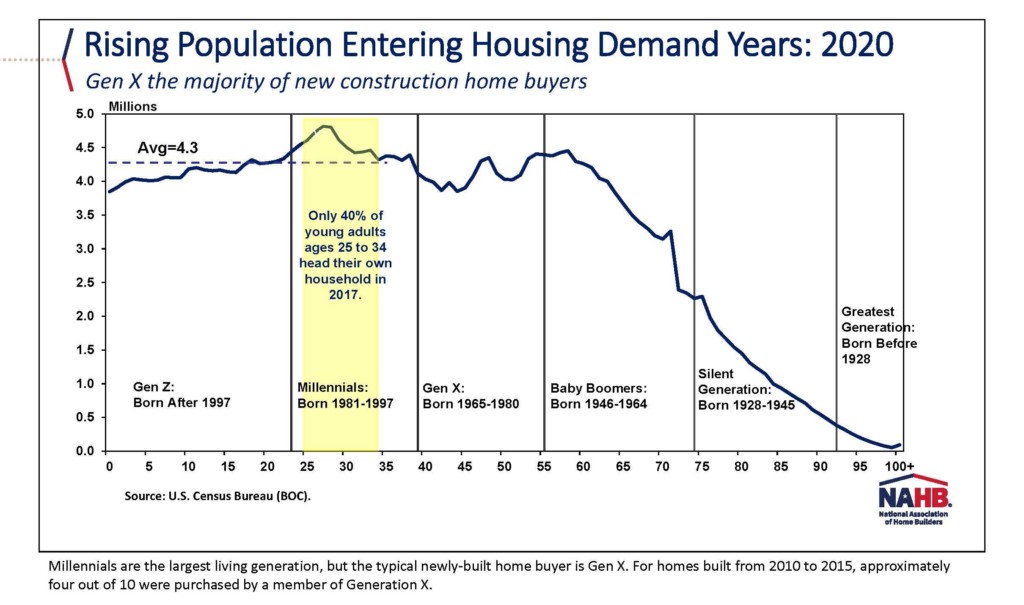

Millennials are the largest living generation, but they’re not today’s home buyers. That would be Generation X. From 2010 to 2015, approximately 4 out of 10 newly built homes were purchased by a Gen Xer. A couple things to watch:

- Will Gen X continue to buy new homes?

- Will Millennials, who are entering the typical housing demand years, start to move the numbers?

2. Finding skilled labor is still a challenge.

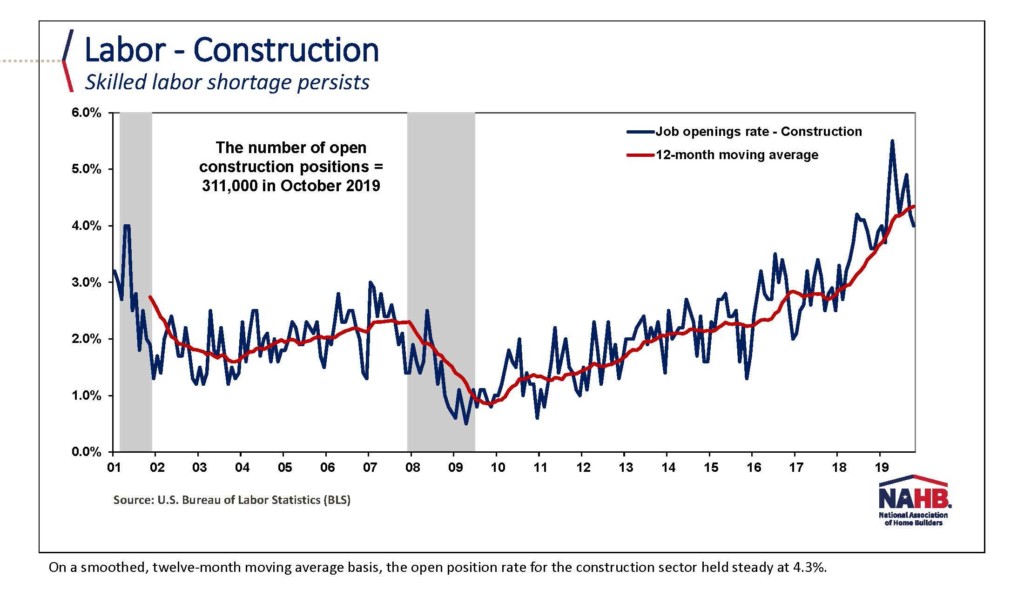

There will continue to be labor shortages in both the manufacturing and construction sectors and is something that the industry has been managing since at least mid-2018. In manufacturing, there were 477,000 openings in October 2019. Manufacturing job demand is expected to slow as sectoral growth slows. In construction, meanwhile, there were 311,000 openings in October 2019. The skilled labor shortage is expected to persist—at least in the near term.

3. Regulatory costs are rising.

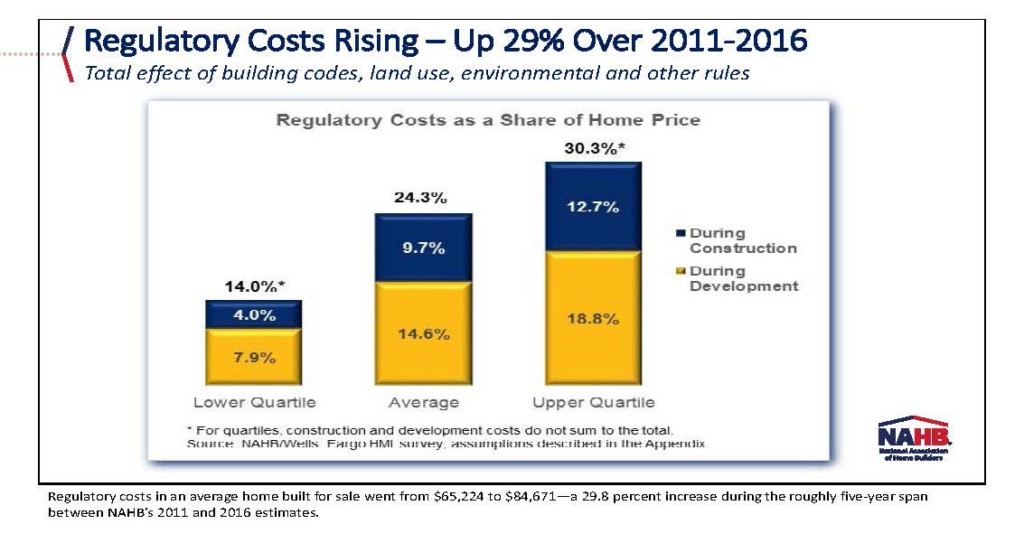

The costs for land use, building codes, environmental rules, and other federal, state, and local regulations can account for 14 to 30 percent of the cost of a new home. And the trendline suggests those costs, which have been rising since at least 2011, are only going to continue. The regulatory cost of a new home went from $65,224 in 2011 to $84,671 in 2016. The average cost of regulations for multifamily homes—at 32 percent—is even higher. That includes cost increases for changes to building codes, zoning, and more.

One more key trend impacting the vinyl sector.

The residential remodeling market is projected to remain slow in 2020 and 2021, continuing a trend that started in 2019. Although the remodeling market has slowed, it is expected to level off as a result of resales. While demand for remodeling is fueled by a strong labor market coupled with low interest rates, the lack of skilled labor remains a problem.